Christopher Nolan’s “Tenet” is close to hitting $300 million worldwide, but it’s weekend take in North America was just $3.4 million in 2,850 theaters. Thing brings it’s four week haul to $41.2 million in North America. Losing theaters in California and New York to the coronavirus pandemic has had a huge impact on Hollywood, and the new surge in cases will only hurt it more.

The $200 million film brought in $19.2 million worldwide in 58 markets

“Tenet” is the first major studio release to launch during the pandemic, and its small-ish numbers underline the industry’s challenge of attracting customers amid a worldwide health crisis and social distancing restrictions. Disney’s “Mulan”– which isn’t getting a theatrical release in the U.S. — grossed $3.4 million in 20 markets to lift it to $64 million worldwide. Its fifth weekend of “The New Mutants” took in $2.5 million worldwide, including $1.1 million at 2,305 domestic sites.The seventh weekend of Solstice Studios’ “Unhinged” took the third spot with $1 million at 2,182 locations, declining only 22%. The Russell Crowe thriller was the first wide release during the pandemic and has topped $17 million.

Solstice said it plans to keep promoting “Unhinged”: “In the wake of studios moving their major releases out of fall, many theatres are reducing schedules and/or re-closing theatres to save money until more studio product becomes available. We are making every effort to counter balance this with a promotion that will run for the month of October for independent theatres and drive-ins to help incentivize them to keep their doors open and find other companies in their area to partner with to help promote the film.”

Disney also grossed $908,000 at 2,097 U.S. sites for the 40th anniversary re-release of “Star Wars: The Empire Strikes Back” for a fourth place finish, followed by Clouburst’s second weekend of espionage thriller “Infidel” with $745,000 at 1,885 U.S. locations. Sony’s third weekend of romantic comedy “The Broken Hearts Gallery” followed in sixth with $470,000 at 2,141 sites, declining 41%.

Gravitas’ opening of horror movie “Shortcut” debuted in seventh with $305,000 at 725 screens. Sony’s launch of Andrew Cohen’s comedy “The Last Shift” came in eighth with $235,000 at 871 sites followed by Focus Features’ debut of Miranda July’s comedy “Kajillionaire” with $215,000 at 539 locations.

The estimates were released three days after Disney postponed the release of a trio of fall blockbusters — Marvel’s “Black Widow,” Steven Spielberg’s “West Side Story” and Kenneth Branagh’s “Death on the Nile” — by several months. Those delays were the latest in a long line of high-profile titles pushed out of the summer and fall due to coronavirus.

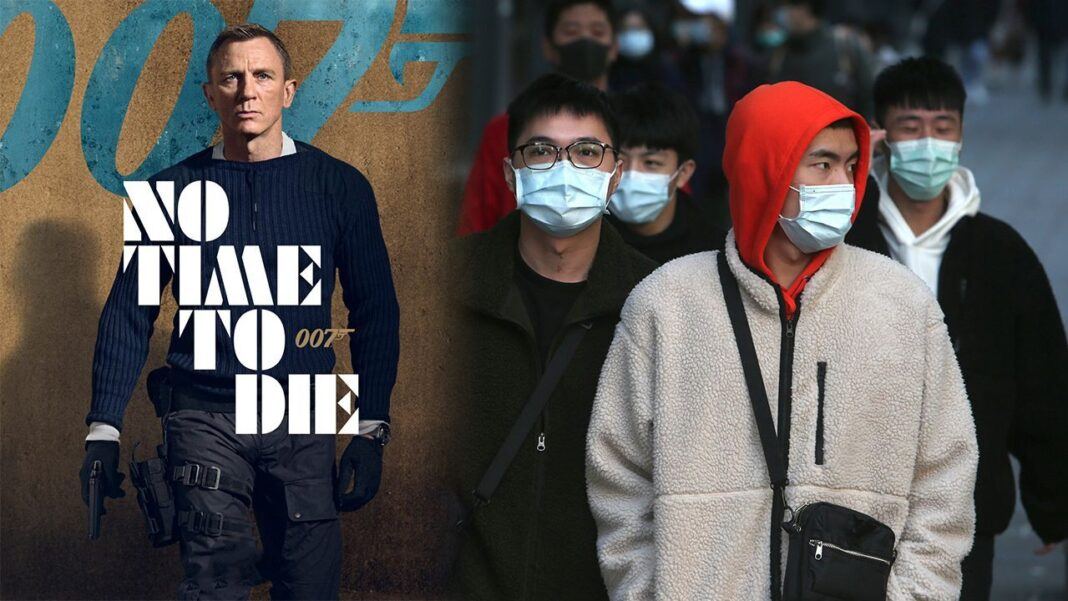

Disney is releasing “The Empty Man,” a horror film with James Badge Dale, on Oct. 23 and its Pixar comedy “Soul” on Nov. 20. Universal-MGM’s James Bond movie, “No Time to Die,” is also slotted for Nov. 20.

Shawn Robbins, chief analyst at Box Office Pro, said it’s no surprise that the U.S. moviegoing business is subdued amid the COVID-19 pandemic.

“This weekend is continuing what’s now expected to become a trend of quieter weekends at the domestic box office in the early autumn weeks following numerous release delays since ‘Tenet’ opened,” he added. “It’s another good news, bad news scenario as ‘Tenet’ itself and other films are displaying stronger legs than typically seen in pre-pandemic times, but the volume of total business in the market is lacking due to modest consumer awareness, the absence of four-quad films, and no promotional engine usually driven by the Los Angeles and New York markets.”

Currently, about 75% of U.S. markets are open but the key Los Angeles and New York markets remain closed along with most of the rest of California, North Carolina, Michigan, New Mexico, Seattle-Tacoma and Portland, except for driveins. Paul Dergarabedian, senior media analyst with Comscore, estimated that only 58% of theaters are currently open in North America.

“The marketplace is as expected sleepy and uncertain,” he added. “However, there is at least some encouraging news in the fact that where people have the option, film fans are heading to the movie theater while others are seeking out the big screen experience even in neighboring cities if their local multiplex is unavailable.”

North America Box Office

Estimated ticket sales for Friday through Sunday at U.S. and Canadian theaters, according to Comscore. Final domestic figures will be released Monday.

1. “Tenet,” $3.4 million.

2. “The New Mutants,” $1.2 million.

3. “Unhinged,” $1.0 million.

4. “Star Wars: Episode V – The Empire Strikes Back,” $1.0 million.

5. “Infidel,” $761.136.

6. “The Broken Hearts Gallery,” $501,197.

7. “Shortcut,” $305,.

8. “The Last Shift,” $246,491.

9. “Kajillionaire,” $215,675.

10. “SpongeBob Movie: Sponge on the Run,” $142,355.

Can James Bond No Time To Die Overcome A Pandemic Box Office

Movie-theater operator Cineworld is still in a parlous position. If James Bond doesn’t save it in November, though, a takeover offer might further down the road.

The London-listed company, which owns Regal Cinemas in the U.S. as well as chains in the U.K., Eastern Europe and Israel, published downbeat half-year results Thursday. Less important than the historic numbers were warnings about the future: It has the cash to take it through its “base case” scenario of a gradual box-office recovery, but not a “severe but plausible downside scenario.” Even in its base case, the heavily indebted company will breach a key year-end banking covenant and has yet to obtain a waiver from lenders. The stock fell 12% in morning trading.

Movie theaters have reopened in most places, but there are important exceptions for Cineworld: New York, parts of California and Israel. Chief Executive Mooky Greidinger expects to get the green light from Gov. Andrew Cuomo in New York “within a week or two”—an event on which his base case depends.

It isn’t just about reopening, though: Much depends on the movie slate. Even in normal times, theaters need splashy releases to get people off their sofas. That makes the deferral of openings by studios a big problem. On Wednesday, Disney said it was delaying the release of 10 movies, including the Marvel spinoff “Black Widow,” by six months. Even big movies that do go ahead offer no guarantee of success. Christopher Nolan’s thriller “Tenet,” this month’s most important release, has performed somewhat disappointingly in the U.S.

At least MGM still seems committed to a November release of its latest James Bond movie, the aptly named “No Time to Die.” Any sign that the suave spy’s schedule also is slipping would be terrible news for Cineworld and its U.S. peers AMC and Cinemark.

As if coronavirus risks weren’t enough, Cineworld also is embroiled in two industry disputes. One is with Canadian chain Cineplex, which it previously wanted to buy. Cineworld pulled out of the deal in June, citing breaches of their agreement, and the two sides are now suing each other. The other is with Universal, following a July agreement between the Hollywood studio and AMC to shorten the exclusivity window that theaters have to show movies from 75 to just 17 days. Mr. Greidinger is adamant that he won’t show movies that don’t respect the old norm.

There is one way in which the Cineworld drama could take a better turn for investors: a takeover offer. Last month, a federal judge signed off on a move to roll back the so-called Paramount Decrees that have barred movie studios from owning U.S. movie theaters for the past 72 years. Disney and some of its peers are already moving rapidly into the retail business through streaming. Adding theaters to their portfolios could be a logical next step—and end disputes about the theatrical exclusivity window once and for all. Admittedly, an imminent transaction is unlikely given the pandemic.

Takeover hopes buoyed Cineworld stock last month, but it has since fallen back to trade at just 2.5 times last year’s earnings. At that price, investors who don’t mind volatility could eventually get a happy ending. Just don’t try to guess the next plot twist.