Currency is as old as human society. We have yet to discover a human civilization so old that the people didn’t use some form of money, be it feathers, beads, or anything else accessible to communicate and exchange value.

That’s all money is, a language. Whether it’s a purple shell or green paper with an old guy on the front, when I hand you money I’m telling you that I would like to exchange this value with you because you have some good or service which I appreciate and value equally.

For more than 3,000 years, precious metals such as gold and silver have been the preferred currencies of nearly every civilization on Earth. Whether it was in rocky lumps or minted into coins and bars, gold brought humans out of the barter system by initiating trading through a universally recognized and valued commodity.

Gold works exemplarily well as a currency: it’s easily recognizable anywhere in the world, scarce, and impossible to counterfeit (though many alchemists have tried). It’s relatively stable and effectively holds its value over time.

It’s not, however, overly portable. Gold, especially in large quantities, is very heavy. As a solution, in the early 1700s, governments began to hold gold and silver reserves, minting coins and eventually printing paper notes backed by the metals. The notes that circulated bearing pictures of kings, queens and presidents had a sort of intrinsic, calculable value thanks to the gold they could be exchanged for.

That all ended in 1971 when the financial strain of the Vietnam War forced United States President Richard Nixon to end the convertibility of the U.S. dollar to gold—a move which ignored a precedent set by all recorded history.

Now, Money is Whatever Governments of the World Say it is.

The global monetary system is a perverse mockery. International wealth is materialized from nothing with trillions of dollars, pounds, pesos, rupees, and yuan printed and backed only by the “full faith and credit” of the government controlling it. U.S. and British gold reserves account for less than five percent of the dollars and pounds in circulation today, respectively. With government printing presses working around the clock, money is no longer scarce or limited; it’s artificial.

Since then, gold has skyrocketed from the $35/oz. conversion rate offered by the U.S. government. By 1980, an ounce of gold was worth nearly $700. The price, however, would continue to fluctuate based on the economic health and political stability of the world’s superpowers. In late 1999, a gold ounce was around $250.

The world has witnessed a lot of craziness since then, including the dot-com bubble; the energy crisis; the United States housing collapse (and ensuing global recession); and banking and monetary crises in Iceland, Ireland, Russia, Argentina, Spain, Portugal, and Greece to name a few notable occurrences. This uncertainty and instability drove gold to an all-time high of $1,895 per ounce in 2011.

People around the world rushed to gold as a safe storage of their value as worthless fiat currencies collapsed. For example, the Argentine peso has an inflation rate of nearly 50 percent a year over the past decade. Thus, if you live in Argentina, and you work for pesos, there’s almost no point in saving money. 100 pesos today is worth about 50 pesos in one year and then 25 pesos in another year.

Savings accounts are pointless in such a situation, but the need to save and store money doesn’t go away. Thus, people turn to commodities such as gold. While their pesos may decrease in value, the gold holds its value as the markets adjust to the inflation. That is, if you put 100 pesos in gold today, you can sell that gold for 150 pesos in one year. So, five years later, you can cash-out the gold you’ve been saving at the current rate and buy a house. You didn’t make any more (because housing and other prices will have adjusted for inflation as well); however, you managed to save and store your value without losing half of it every year.

In 2009, while this gold rush was going on, the first digital currency arrived: bitcoin.

Bitcoin is Money in its Most Abstract Form: Language.

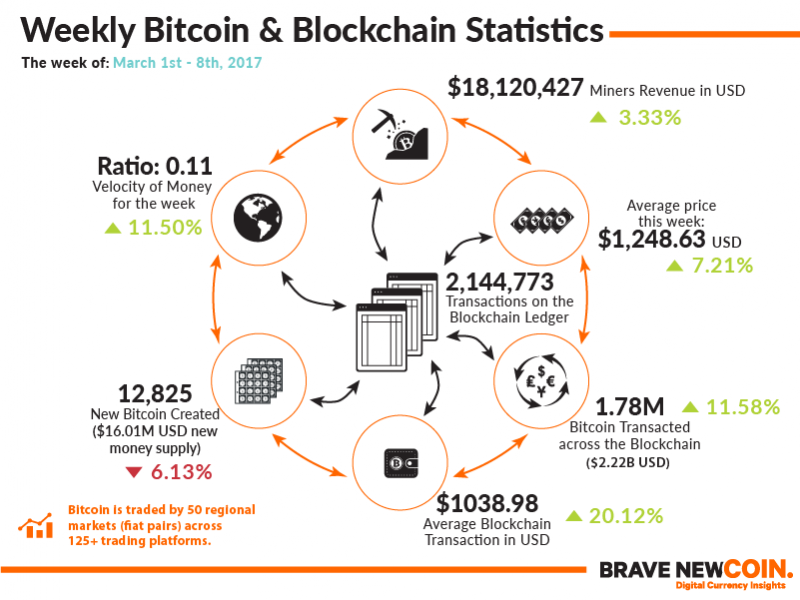

Bitcoin (BTC) runs on the Blockchain, a decentralized, transparent ledger which records all transactions through a series of algorithms and mathematical calculations to prevent counterfeiting and double-spending. This system allows for peer-to-peer transactions online with no interference from any central authority or bank. The Blockchain is constantly monitored and secured by “miners” all around the world, which use their computing power to confirm transactions, creating new bitcoin in the process.

The production of new bitcoin also follows the algorithm, creating 12.5 new bitcoin every ten minutes. Like gold, bitcoin is not infinite: new bitcoin will be generated until there are 21 million in existence, at which point production stops.

Bitcoin is digital gold—I mean that completely literally.

Bitcoin boasts all the critical features of gold: a global economy, no absolute monetary authority such as a government or central bank, a limited and predictable supply, virtually no arbitrage or inflation, and no seigniorage (government revenue on the difference between the face value of the currency units and the cost to produce them)—you even mine it.

BTC is not controlled by any government. The United States or China cannot generate 100 bitcoin out of thin air. And the entire system is backed by the full faith and credit of math, not a body of potentially corruptible people.

Bitcoin also has two important feature, both wholly necessary for any currency, that gold lacks in today’s global economy and market—ease of transmission and divisibility.

A New and Improved Gold Standard.

While gold coins may have worked for medieval societies where all transactions happened in person, they simply do not have the same utility today when you need to send money to someone in China or England or make a purchase online. It’s for this reason that over 90 percent of the U.S. dollar is electronic and moves from person to person via bank transfer, PayPal, or other online services.

Additionally, gold does not allow for micro-transactions or every-day purchases. If I have a gold 1/10-oz coin (worth around $125), I can’t buy a $5 sandwich. What am I supposed to do? Cut my gold coin into 25 equally-sized pieces?

Gold is almost too valuable. Silver (around $18/oz.) offers an easier avenue for low-dollar, every-day transactions; however, it still has its limits in terms of divisibility, and when more than half of the world survives on $2-10 a day, micro-transactions are crucial.

In the slums of India, Africa, and South America, people rent solar panels for a few cents a day to affix to their huts to charge their Nokia phones. They buy one cigarette at a time. You can even find areas where they will buy a squeeze of toothpaste at a time because the whole tube would be too expensive.

Gold is out of the question. Silver won’t work. Fortunately, even the poorest parts of the world today have cell phones with Internet access. Bitcoin can be divided to the eighth decimal place. One Satoshi (0.00000001 BTC) is worth around $0.000012 right now. One liter of filtered water in the Central African Republic will run you about $0.10-0.50, and bitcoin is ready to cover it.

The Market Agrees.

2016 saw its fair share of unrest in the markets and various countries. The problems in Greece got worse, Venezuela is on the brink of social collapse, oil prices plummeted, China’s economic growth slowed significantly, India declared war on large-denomination banknotes —and I’m barely scratching the surface. The United States elected and then-President-Elect Donald Trump also contributed to the growing uncertainty around the world.

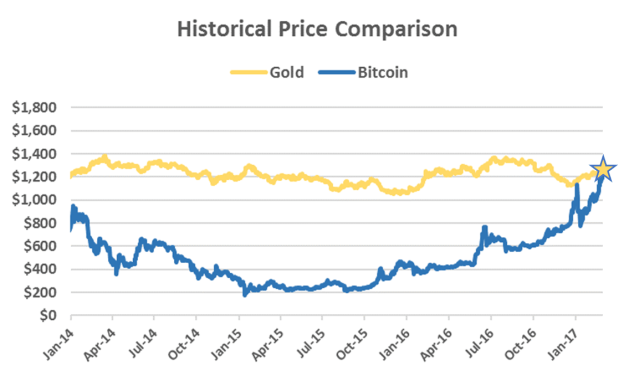

A register of events like these, historically, would drive money into gold and other commodities. And it did to a degree: gold prices had jumped about $300 by July 2016; however, much like the past three years (over which gold has lost nearly 40 percent of its value against the U.S. dollar), most the rally was lost. Gold finished the year up 8.5 percent against a strong dollar.

Amazingly, Bitcoin finished the year up more than 125 percent. After another price surge in early 2017, one bitcoin was worth more than an ounce of gold, leaving gold bugs scrambling for answers as tech nerds kicked their feet up and said: “I told you so.”

While some financial “experts” are trying to downplay the bitcoin-gold price parity, the milestone is significant, especially in the context of world events in 2016. Investors and the distraught alike universally ran to magic Internet money over a precious metal that has been the monetary standard for nearly all human history. People universally decided in 2016 that bitcoin is a more reliable storage of value than a chunk of gold.

Both currencies are decentralized. Both maintain their value as worthless fiats rampantly inflate. But only bitcoin can be sent halfway around the world, instantly, for virtually nothing. And if you live in a corrupt nation such as Venezuela where police and government officials are knocking down doors and stealing anything not nailed to the floor, only the encryption algorithms of bitcoin can provide true fiscal security.

Modern-Day Gold.

Think of bitcoin as gold for the Internet-age. No, bitcoin’s price will not permanently remain above that of gold. In fact, it dropped below gold again a few days later. There will still be fluctuations. BTC is not perfectly stable, and it’s still in its infancy (especially compared to gold).

But just remember what the market is trending towards. Over the next few decades, we’ll have many more monetary crises coupled with plenty of global unrest. We’ll probably live through another housing collapse, a little bit of war, and a few coups around the world. We’ll also see a stronger movement back to the equity-based currency system, one backed by real assets, that was in place for more than 99 percent of human history.

And if 2016 is any indication, people will choose math and computer algorithms over hunks of metal. To learn more about bitcoin check out Yellow Card.