The Future of Money: Top 10 Misconceptions About Bitcoin and Cryptocurrency

Most people have heard of Bitcoin. But how much do you actually know about the currency?

Bitcoin is a revolutionary technology in which your money is completely in your control. With Bitcoin, you can send money to anyone, anywhere in the world, virtually free, with no banks or other third-parties interfering or taking a cut. All transactions happen at a peer-to-peer level similar to the exchange of physical cash.

All Bitcoin transactions are recorded on the Blockchain—a public ledger distributed amongst computers all over the world which provides a digital record of all transactions while preventing counterfeiting and double-spending. The Blockchain is the true societal breakthrough of Bitcoin technology, as it enables the recording and verification of anything and everything from financial transactions (i.e. Bitcoin and securities) to voting. All entries are publicly displayed while, at the same time, the participants’ identities remain anonymous.

Unfortunately, the mainstream media, especially in the United States, has taken the offensive against cryptocurrencies, mainly because it threatens the established banking oligarchy that has ruled the financial industry for well over a century now. Although most people have heard of Bitcoin, there is a lot of false information out there perpetrated by news corporations and banks.

That crazy online currency that took the world by storm back in 2009 has since evolved into a thriving industry with a market cap of over $14 billion. Bitcoin offers boundless opportunity to people all over the world, no matter their age, race, or financial position. It is important to differentiate between the truth about Bitcoin’s features and the scare pieces run about the new currency.

Let’s clear up the Top 10 misconceptions surrounding Bitcoin, cryptocurrency, and the future of finance:

Bitcoin is Dead, No One uses it, and it’s Not that Special

I hear this all the time: does anyone use Bitcoin? I’ve heard it’s not doing too well. News flash—Bitcoin is killing it. However, as with any disruptive technology, it may take a while for the masses to catch on.

When the automobile was first invented it was deemed a dangerous death trap that could never match the efficiency of the horse-drawn carriage. Today, of course, nearly 90 percent of American households have at least one car. Interstates, highways, and vehicles that travel 70 miles an hour make long-distance trips easier than ever. Could you imagine having to go cross-country on horseback?

Similarly, Bitcoin aims to revolutionize banking and finance the way automobiles did transportation, making it easier, quicker, and safer than ever. However, much like in the early days of the car, the media pundits and big banks want to write cryptocurrency off as a fleeting fad.

Unfortunately for them, Bitcoin is stronger than ever, and it’s here to stay. Bitcoin has a market cap of over $14 billion, a price up over 120 percent this year, and billions of dollars flowing into the industry. With $490 million in venture capital in 2015 (up from $362 million in 2014), companies will continue to grow over the next many years. Institutions from Nasdaq and Goldman Sachs to IBM and Microsoft have put big dollars into private blockchain tech. Overstock.com recently issued stock exclusively on the blockchain. JP Morgan earmarked $9 billion for research. Wallets numbers are doubling yearly, daily exchanges have quadrupled, and waves of new users join the revolution every day. Nearly every country in the world has a thriving cryptocurrency industry.

Sure, Bitcoin isn’t the number one currency in the world yet, but with over 3,000,000 BTC (around $2,700,000,000) sent and received daily only eight years after the release of an anonymous white paper, Bitcoin is far from dead.

Only Criminals use Bitcoin

When the media reports on Bitcoin, it’s either dead or only used by criminals to buy and sell drugs online on the Dark Web. They don’t report on how Bitcoin has the potential to open up financial markets around the world; they’d rather tell you that if your son is using it he’s either shooting heroine or getting ready to buy it.

Yes, Bitcoin is used by criminals. So are the Internet, banks, and credit cards. No, the majority of Bitcoin users are not criminals. Regardless, it doesn’t matter that Bitcoin is used by criminals.

Let’s go back to 1991 when the Internet was just beginning to rear its ugly head. It was pornographers and thieves, and that’s about it. But that didn’t matter. The Internet is a robust technology that does much more good than bad. People saw that in the 90s. Now, this technology that was at one time considered nothing but a haven for pirates and scammers has brought us all closer and made life easier for good people all over the globe. Humanity is more interconnected now than at any other time in world history. And, call me an optimist, but I say there are a lot more altruists out there than criminals.

Additionally, although Bitcoin is technically anonymous, it does leave an extensive paper trial on the blockchain which law enforcement has proven able to follow with some help from subpoenas to exchanges and wallet services. Criminals cannot hide behind Bitcoin.

Bitcoin isn’t Safe

On the contrary, Bitcoin is about the safest currency you can use—if you use it properly.

Sending Bitcoin is as easy as it gets; however, it is important to remember that Bitcoin transactions are irreversible. Once you send the coins, only the receiver can issue a refund. The Bitcoin Network prevents you from sending money to an invalid address, but it is crucial that you do not send to anyone you don’t trust.

When handling Bitcoin, storage is key. Like your physical wallet, your Bitcoin wallet must be secured. Bitcoin wallets have two strings of random letters and numbers: your public key for receiving Bitcoin, and your private key which allows you to send BTC to other wallets. Your public key may be shared with anyone—your private keys need be guarded like your banking information or Social Security Number.

It is also important to pick a reliable wallet service. The Bitfinex exchange, for example, shouldn’t be trusted with large quantities of cryptocurrency after the hacks. Companies like BitGo and Exodus, on the other hand, have a strong track record of security. As you get more advanced in the cryptocurrency space, offline wallets (i.e. paper wallets) offer the top level of security obtainable.

I Can’t Afford A Whole Bitcoin

With the price of Bitcoin breaking $900, 1 BTC is more than most people are willing to shell out for, especially all at once. Fortunately, Bitcoin is more divisible than any other currency in the world. Bitcoin can be split up to eight decimal places. One satoshi, the smallest currency unit possible, is equal to 0.00000001 BTC, which is about $0.000009.

Reversely, Bitcoin doesn’t limit the high rollers either. The largest Bitcoin transaction so far was 194,993 BTC back in 2013 (about $147 million at the time). The Bitcoin was delivered to the receiver instantly for about $0.10.

There’s Nothing To Do With Bitcoin

Bitcoin is a currency in the same way that the U.S. Dollar or the Japanese Yen is a currency. Unlike other currencies, however, Bitcoin has no geographical boundaries. Bitcoin does everything other currencies do, except on a global scale.

You can use Bitcoin to buy stuff. Companies such as Overstock.com, New Egg, and Microsoft accept BTC, and others, such as Purse.io, allow users to pay with Bitcoin anywhere they shop and even receive discounts up to 15 percent on sites such as Amazon.com. You can even get a Visa debit card attached to your Bitcoin wallet and hit the mall like you would with any other card.

Bitcoin and other cryptocurrencies are also more volatile than fiat currencies (currencies, such as the U.S. Dollar or Mexican Peso, that a government declares to be legal tender not backed by any physical commodity), allowing those who know how to play the markets the opportunity to earn a pretty penny trading. Hedge funds and investment firms have also begun adding the currency to their portfolios. Even if you have no idea how to work an exchange, you can get rich just sitting on the currency: Bitcoin went up over 120 percent against USD in 2016.

Bitcoin is too Volatile

Yes, Bitcoin is more volatile than the U.S. Dollar. No, it is not dangerously unstable.

At the end of 2013, the United States Congress discussed Bitcoin briefly. That acknowledgment of the cryptocurrency sent the price skyrocketing from about $200 at the beginning of November 2013 to an all-time high of over $1,200 by the end of the month.

As the hype cooled down, the price began to rise and fall sporadically throughout any given day. Since the beginning of 2016, the currency has consistently and gradually gained (rising over 120 percent overall in 2016).

Barring the intense period of trading after the $75 million Bitfinex hack, BTC has become relatively stable against the U.S. Dollar, while still fluctuating just enough to make day trading profitable. At this point in time, Bitcoin is as stable as Twitter stock or comparable securities, which is prone to big gains and losses but typically moves no more than 5 percent any given day.

Bitcoin could be Shut Down

People ask what happens if Bitcoin gets shut down. If someone, somewhere wipes the server and all of it is just gone. Well, that isn’t how it works. The blockchain is distributed across computers around the world. There’s no off switch.

The blockchain is secured by nodes, computers around the world which have the entire ledger downloaded. Anyone can be a node. Every time a transaction is initialized, the Bitcoin is traced from its inception to the current location on the blockchain to ensure that it is legitimate. This process involves complicated mathematical algorithms worked by computers called miners. Anyone can mine Bitcoin. In exchange for their processing power, miners are rewarded with newly generated Bitcoin that will enter circulation. There’s no central bank deciding when to release new coins.

Bitcoin is the most secure currency in the world, not in exchange price necessarily, but in terms of possession. Bitcoin (along with other blockchain assets and currencies) is the money in its most abstract form—value. With Bitcoin, you own your money, and thanks to the indisputable distributed blockchain ledger, you can prove ownership beyond any doubt.

Other currencies exist in a master-slave architecture between you and the banks. As with any master-slave relationship, you must ask yourself, ‘Which am I?’ I don’t think you’ll like the answer.

“This is a client-server relationship. Because that money only exists as a form of debt in a ledger that you do not control,” said acclaimed Bitcoin expert Andreas Antonopoulos in a 2015 speech at Erasmus University in Rotterdam, Netherlands. “A ledger that is stored by a server, and you are simply a client. In fact, you have no control at all.”

With fiat currency, you are the client, not the server. You are the slave, not the master. Today, I can drive to the nearest ATM machine and withdraw $100. However, one day, my bank may decide it does not want to give me anything because it doesn’t have to. And there’s nothing you can do about it—just ask the people of Venezuela who are living this nightmare right now. Or the people of Greece, Argentina, Brazil, and so on. You get the point.

There is no debt in Bitcoin. If I control my private keys, I control my Bitcoin. No one can prevent me from withdrawing, sending, trading, or spending my BTC. My money is my money once again.

Bitcoin is the Only Legitimate Cryptocurrency

Bitcoin is the undisputed champion of cryptocurrencies. No arguments there. It accounts for about 85 percent of the market cap for the entire industry. But while Bitcoin may be the most popular cryptocurrency, it is by no means the only one. There are over 700 Altcoins out there.

They all work about the same. They are recorded on a blockchain (more often than not, the Bitcoin Blockchain), allow for virtually free and instant transfer of value anywhere in the world, and enable peer-to-peer financial transactions. Many Altcoins offer amazing, unique features. Here are three of my personal favorites:

Ethereum (ETH): Ethereum is programmable money. The platform enforces and executes peer-to-peer “smart contracts,” allowing users to do anything from betting on a football game to paying for the electricity used to charge their car battery all without any third-party interference. Ethereum promises to be the death of “share apps” such as Uber, Lyft, and AirBnB by promoting the same service over the blockchain without the company in the middle taking a cut.

Tether (USDT): Tether pegs its value against that of the U.S. Dollar by backing 100 percent of Tether with USD reserves. 1 USDT is always equal to $1. Tether also offers support for the Euro, allowing both fiat currencies to be easily exchanged and transmitted over the blockchain, circumventing banks and avoiding the volatility of other cryptocurrencies.

Counterparty (XCP): The Counterparty platform allows anyone to take full advantage of blockchain technology without writing a single line of code. XCP is created by “burning” Bitcoin, permanently removing the BTC from circulation. The Counterparty platform allows users to make their own blockchain assets. I can distribute shares of my company, pay dividends, and even sell my house over the blockchain by assigning a value to tokens on the protocol. Imagine transferring your car title as easily as sending an email. And without the paperwork and fees.

The Technology Requirements Discourage Mass Adoption, Especially Amongst the Poor

The United States government estimates that less than 10 percent of the over $1.4 trillion of USD in circulation today exists in cold hard cash. The rest is digital money. Be it on a PayPal account or your bank’s controlled ledger, the U.S. Dollar is almost all digital. We’re already used to it. No issues here.

In America, we’re blessed with ready access to financial instruments, a bank account, capital pools, and international markets. Billions of people around the world don’t have such opportunity.

Bitcoin gives them a connection to all that and more, while at the same time exponentially improving these tools in the first world as well. Mobile banking puts your bank account in your pocket; Bitcoin puts an entire bank in your pocket.

Bitcoin requires minimal technology. A cell phone with Internet connectivity will do. Thanks to Nokia, even the most remote regions of Africa have a cell tower and a solar panel feeding power to a tiny mobile phone. The average income in some of these areas is $2 a day, but you will find a Nokia 1000 charging in a mud hut.

Now, thanks to Bitcoin, that farmer outside Mombasa, Kenya, has equal access to capital to get a loan to buy seeds for next season’s harvest. The entrepreneurially-minded teenager in Nepal can sell equity in his new small business on the world market. A father working in America can remit the full $100 a week to Nicaragua instead of losing $15 to Western Union—a world of difference to his family struggling to get by on what little they have.

Bitcoin is not only the currency of the people, it is also the currency for the people.

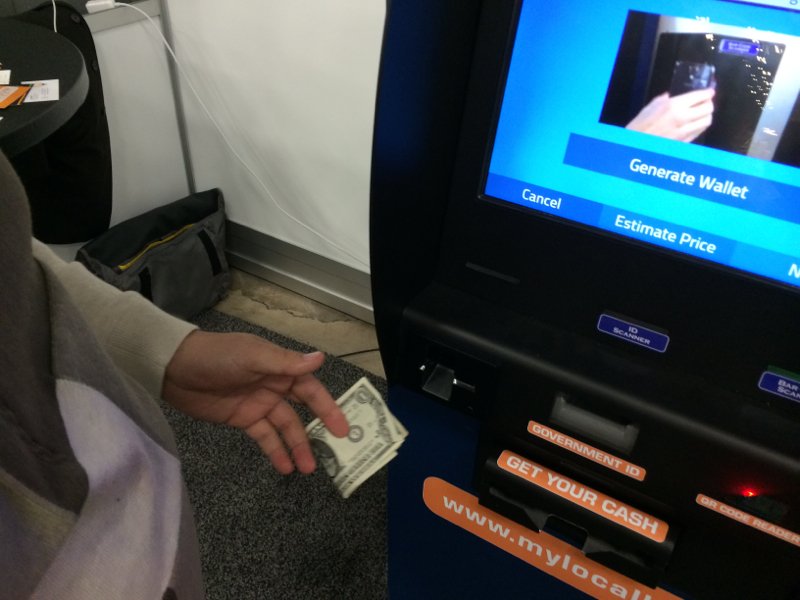

Cryptocurrency is Very Difficult to Obtain

Okay, this one is true. Bitcoin has become an absolute nightmare to acquire. All cryptocurrencies have. Bitcoin companies and exchanges are attempting to centralize these decentralized currencies through complicated customer experiences, excessive delays, hidden fees, and stringent limitations.

I’ll walk you through the process of buying $100 of Bitcoin on two of the most popular platforms in the world, Coinbase and Bitfinex.

Coinbase: Sign up, apply to buy BTC with name, address, phone number, proof of address, date of birth, a scan of your ID, your Social Security Number, etc. Initiate an ACH transfer (the money is deducted from your bank account immediately). Wait 7-10 days as your BTC fluctuates in value. Receive Bitcoin.

Bitfinex: Sign up, apply to buy BTC with name, address, phone number, address, date of birth, scan of ID, Social Security Number, etc. Go to the bank and initiate a wire transfer to their overseas bank account. Pay the $50+ wire fee. Wait 5-7 days for Bitfinex to credit your account. Place a buy order on their USD/BTC books. Wait for the order to be filled. Receive Bitcoin.

I think you get the point. However, there is another option.

Yellow Card Financial was created with the customer experience in mind. With the Yellow Card gift card, users can now go from fiat to cryptocurrency in under 5 minutes.

Yellow Card: Sign up with name, email, and phone number, buy a Yellow Card gift card, redeem online to instantly load your account, receive cryptocurrency.

Much easier, right? The best part is, Yellow Card sends your cryptocurrency directly to your wallet. No need to worry about the dangerous storage practices of other companies that put your money at risk.

Additionally, Yellow Card offers support for over 80 Altcoins. You may also fund your account by selling your Bitcoin and Altcoins to Yellow Card. Within the first few months of launch, Yellow Card plans to add cash-out solutions for nearly 100 countries including in-person cash pickups and bank transfers in over 60 fiat currencies.

Yellow Card puts the power of cryptocurrency back in the people’s hands—you know, the way cryptocurrency is supposed to be.

You may sign up for Yellow Card’s newsletter to receive updates and launch details at http://yellowcard.io.

So, now that you’re a regular Bitcoin guru, you can practice by sending money to the address below. If you are using your wallet’s mobile app, you can scan the QR code. Otherwise, copy and paste the Wallet ID.

1NCCc9VwGLAMP94KFQWeQznW839k93NRdd